Malaysia Tax Advisor Labuan

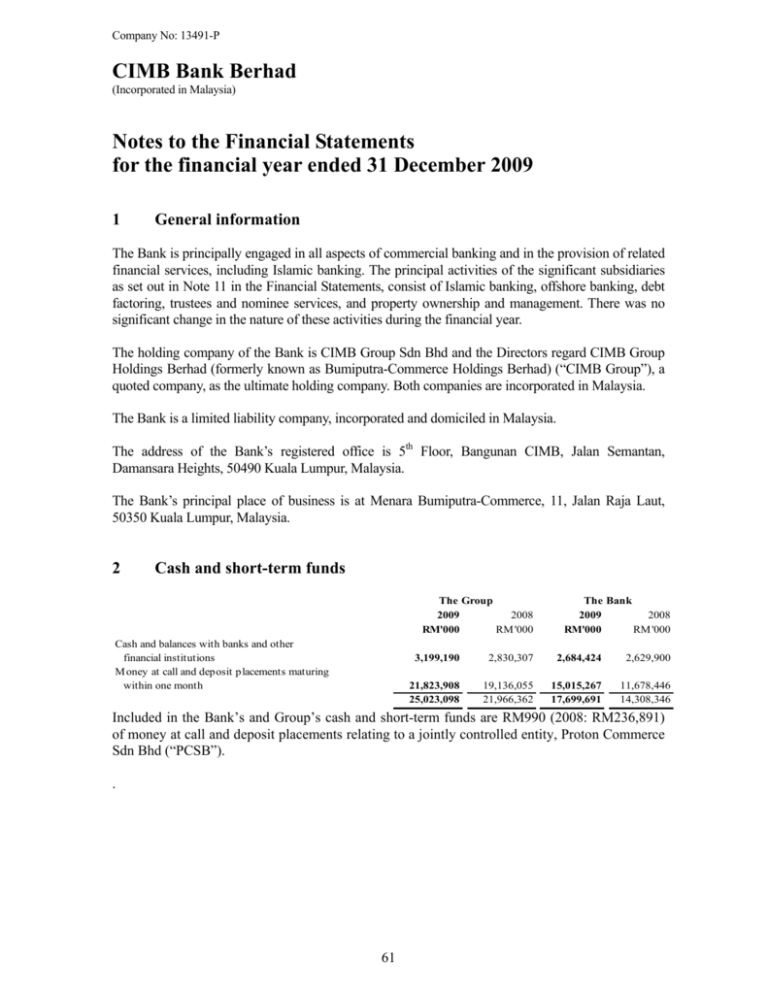

Expatriates receiving income Directors fee salaries allowances from a Labuan Company is required to lodge their annual tax return with Malaysia Inland Revenue Board. Labuan trading activities include banking insurance trading management licensing and shipping operations.

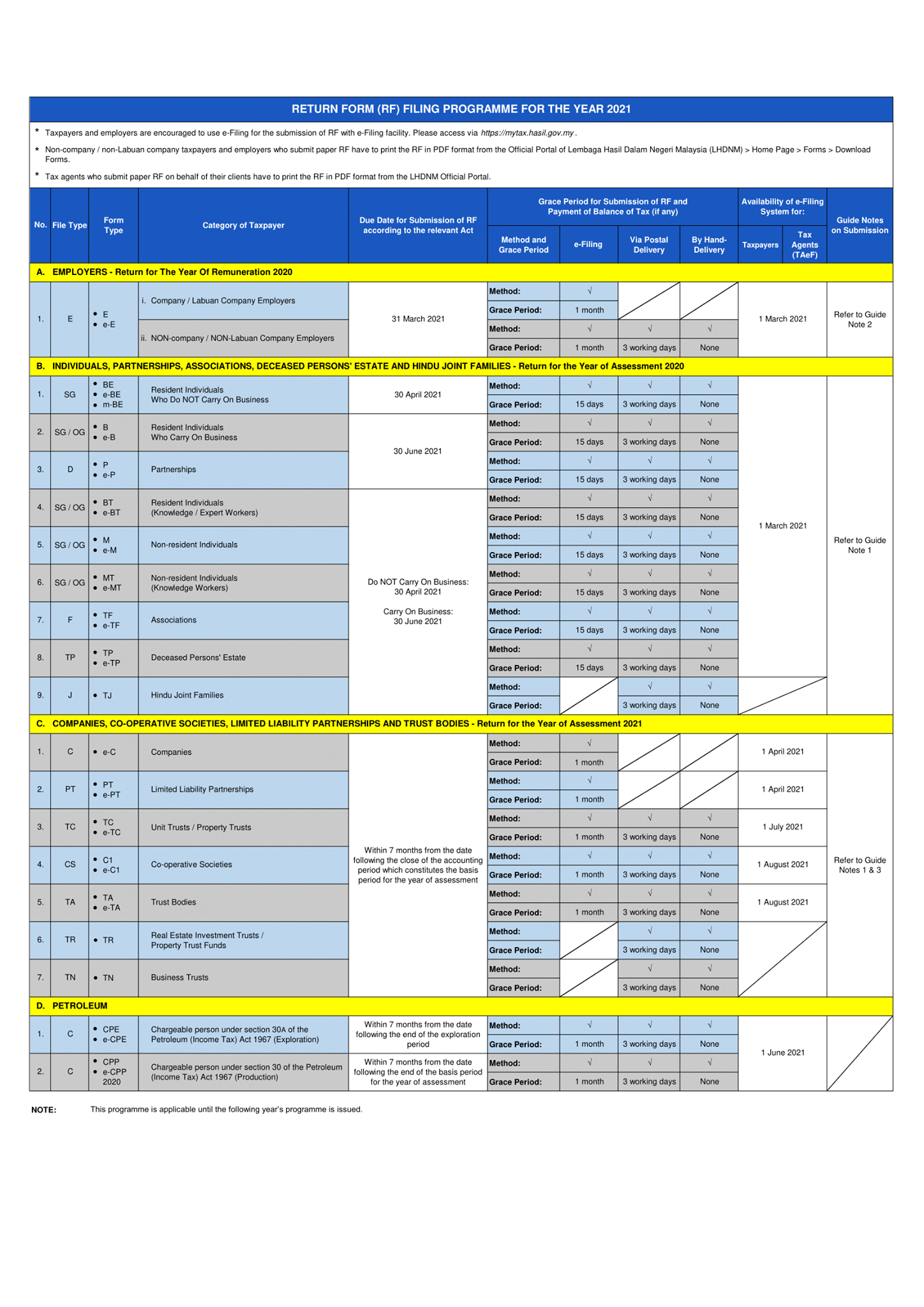

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

Serasa to Labuan or Lauban to Serasa can use the following including saloon car and a driver would cost B50 one-way MVP and a driver would cost you 70.

Malaysia tax advisor labuan. Search and apply for the latest Technical tax advisor jobs in Labuan. Free fast and easy way find a job of 34000 postings in Labuan and other big cities in Malaysia. Free fast and easy way find a job of 35000 postings in Labuan and other big cities in Malaysia.

CoReg No 339182-T Unit 1501 Level 15 Plaza 138 No 138 Jalan Ampang 50450 Kuala Lumpur Malaysia Same building as Maya Hotelopposite KLCC. Malaysia has entered into more than seventy treaties for the avoidance of double taxation and part of these agreements also apply to Labuan as a federal territory. It is also known as an offshore financial centre offering international financial and business services.

Travelling with Labuan can be a great experience. Adam tax advisory sdn bhd 934808-t. The due date for personal tax filing is 30th April annually.

Tax Advisory Services jobs in Labuan Malaysia - Check out latest Tax Advisory Services job vacancies in Labuan Malaysia with eligibility salary companies etc. Malaysia Tax Haven Over the past 10 years approximately Labuan has registered a simple 2500 companies as compared with some Caribbean jurisdictions with more than 100000. Taxation for Labuan International Company Tax Rate and Compliance.

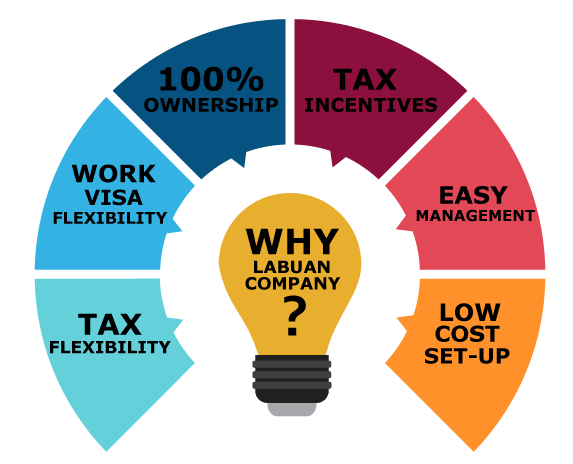

Other taxes on companies levied in Malaysia include the capital duty tax the real property tax the payroll tax and the social security tax payable both by the employer and the employee. Although Labuan is a federal territory within Malaysia there are preferential tax treatments for companies conducting. The Labuan Tax framework Labuan is an island in the South China Sea off the coast of the state of Sabah in East Malaysia.

Labuan is a special tax zone of Malaysia located near to Brunei. Pcs tax. The accounts has to be audited by an approved Labuan auditor and be filed to the local IRB annually.

All business owners of Labuan International Company must perform regular compliance for the companies they own to avoid any future complications and penalty. To travel from Serasa Brunei to Lauban find the following-From Muara One Way and Serasa Terminal Tax. Vision tax advisory sdn bhd 718996-v aljafree tax advisory sdn bhd 1382261-v pioneer tax advisory sdn bhd 1186285-u rayford advisory sdn bhd 956377-v profile.

The comprehensive range of tax benefits available in Labuan IBFC makes it a very attractive jurisdiction for a variety of business and financial activities. The tax year is generally the same as the accounting year and companies must file the tax returns under a self-assessment. Labuan company that have opted to be taxed under the Malaysia Onshore Income Tax Act 1967 will follow the local corporate tax rate of 17 on the first RM 600000 followed by 24 on subsequent chargeable income.

Imc holding malaysia sdn bhd 69276-k profile. The key benefit of selecting Labuan as a corporate base is that it benefits from a very favorable tax regime whereby either a company can be taxed on the basis of a tax rate of only 3 which also requires the submission of annual audited. The corporate income tax is the main tax levied on companies incorporated in Labuan.

Ecovis malaysia tax sdn bhd 361101-m profile. In this article Goh Ka Im Partner and Head of Tax and Revenue Practice Group Messrs Shearn Delamore Co compares the different tax treatments that apply to Malaysian and Labuan entities. Search and apply for the latest Tax advisor jobs in Labuan.

Malaysia personal tax calendar is based on the period of 12 months from 1st Jan to 31st December each year. Many foreigners prefer to register Labuan Company to eligible to enjoy 100 foreign ownership and the other attraction is the flexible tax declaration. However benefiting from these treaties is subject to certain conditions and not all countries recognize Labuan as being part of Malaysia for the purpose of applying the treaty.

Labuan is likewise a member of the despised family of tax sanctuaries that the Organization for Economic Cooperation and Development OECD is aiming to bridle. Labuan entities carrying on a Labuan business activity that is a Labuan trading activity generally are taxed at 3 of their net audited accounting profits chargeable profits under the Labuan Business Activity Tax Act 1990 LBATA.