Labuan Non-trading Activity Tax

A Labuan non-trading activity is defined as activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan. Means an activity relating to the holding of investments in securities stock shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

A Guide To The Gift Programme Finance And Banking Malaysia

Offshore companies in Labuan have a special tax status.

Labuan non-trading activity tax. Labuan non-trading activity means an activity relating to the holding of investments in securities stock shares loans deposits or any other properties by a Labuan entity on its own behalf. Capital Gains For Labuan entities carrying on Labuan trading activity and both Labuan trading and non-trading activities the gains would be reflected as part of the net profits and subject to 3 tax. Only applicable for Labuan Entity that has no tax outstanding including compound and tax increment.

Labuan trading activity includes banking insurance trading management licensing. Labuan entities can now undertake a Labuan business activity with Malaysian residents and using the ringgit currency whereas previously business activities could only be done in from or through Labuan utilizing a foreign currency and with a non-residentLabuan. Labuan trading activities include banking insurance trading management licensing and shipping operations.

The companies that issue shares or participate in other types of investment activities shall be exempt from paying tax. In the case of a Labuan entity carrying on a Labuan non-trading activity which would basically include all investment activities there is no charge to tax. Companies carrying out only Labuan non-trading activity is not charged tax ie.

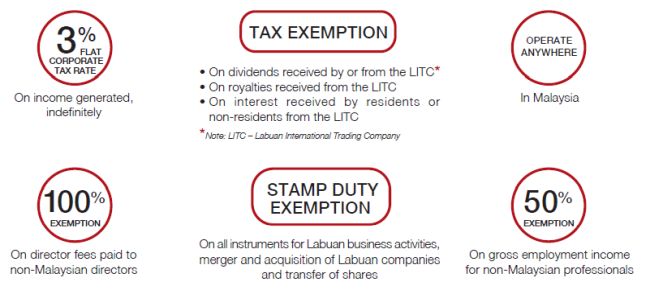

Resident companies in Labuan are subjected to a Corporate Income Tax rate of 3 on annual audited taxable net income under Labuans Tax Regulations. The main tax advantages for investors who choose to open a company in Labuan include a low 3 tax rate applicable to income derived from trading activitiesThis means that companies that engage in non-trading activities such as holdign companies are not subject to the tax at all. The rate of tax imposed is 3 of audited net profits for trading activity and 0 for non trading activity provided that the Labuan entities are in compliance with the tax substantial activity requirements.

Businesses undertaking Labuan non-trading activities continue to be exempt from tax under LBATA regulations. For entities carrying on a Labuan business activity income derived solely from the holding of investments by the entity on its own behalf ie Labuan non-trading income generally is exempt from tax under the LBATA. The most important distinction between these activities is that a Labuan non-trading activity is subject to zero percent tax while a trading company is subject to the aforementioned 3 tax.

Trust Companies are compulsory to submit 60 of their clients tax return regardless they are carrying on Labuan Trading business activity or Labuan non-trading business activity or dormant companies. The rate of tax imposed is 3 of audited net profits for trading activity and zero percent for non-trading activity provided that the Labuan entities are in compliance with. Income Tax Act 1967 ITA Other Malaysian non-Labuan entities deriving income from Malaysia are subject to tax under the ITA where the usual rate of tax applicable to companies is.

Instead the tax rate will be fixed at three percent on net profits from Labuans business activities. On the other hand if your business is conducting Labuan non-trading activities our international clients will continue to enjoy legally tax-exempt status and be subject to 0 corporate income tax. Trading companies are subject to taxation.

- Companies carrying a non-trading activities is not charged tax ie. - Taxation of 3 of net audited profits or a flat rate of MYR20000 to be elected yearly if the company is undertaking trading activities. Section 4 of the LBATA imposes a tax rate of 3 for a Labuan entity carrying out a Labuan trading activity.

A Labuan company may make an irrevocable election to be subjected to tax pursuant to Malaysian Income Tax Act MITA 1967 where the prevailing income tax rate is generally 24. And Section 9 of the LBATA exempts a Labuan entity carrying on a Labuan non-trading activity from paying any taxes under the LBATA. In the instance of a Labuan entity carrying on a non-trading activity no tax will be applied for that assessment year.

A competitive tax regime Labuan business activities as defined in the Labuan Business Activity Tax 1990 LBATA 1990 which provides. Define Labuan non-trading activity. There are two types activities that determine the tax treatment of offshore company such as trading and non-trading.

An activity carried on by a Labuan entity that is not a Labuan business activity is taxable under the Income Tax Act 1967 ITA.