Definition Of Labuan Business Activity

View labuan slidepptx from BKAT 3023 at Northern University of Malaysia. Business activities refer to all the economic activities whether directly or indirectly related to making the goods and services available to the consumer and ensure profit earning through customer satisfaction.

Eurasia Trust Ag Bonds Beyond Expectations

Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities.

Definition of labuan business activity. The Labuan Business Activity Tax Requirements for Labuan Business Activity Regulations 2018 Substance Regulations was legislated on 31 December 2018 to set down the substantial activity requirements imposed on Labuan entities carrying on Labuan business activity. Define Labuan non-trading activity. Offshore business activities Offshore tradingnontrading activities Tax.

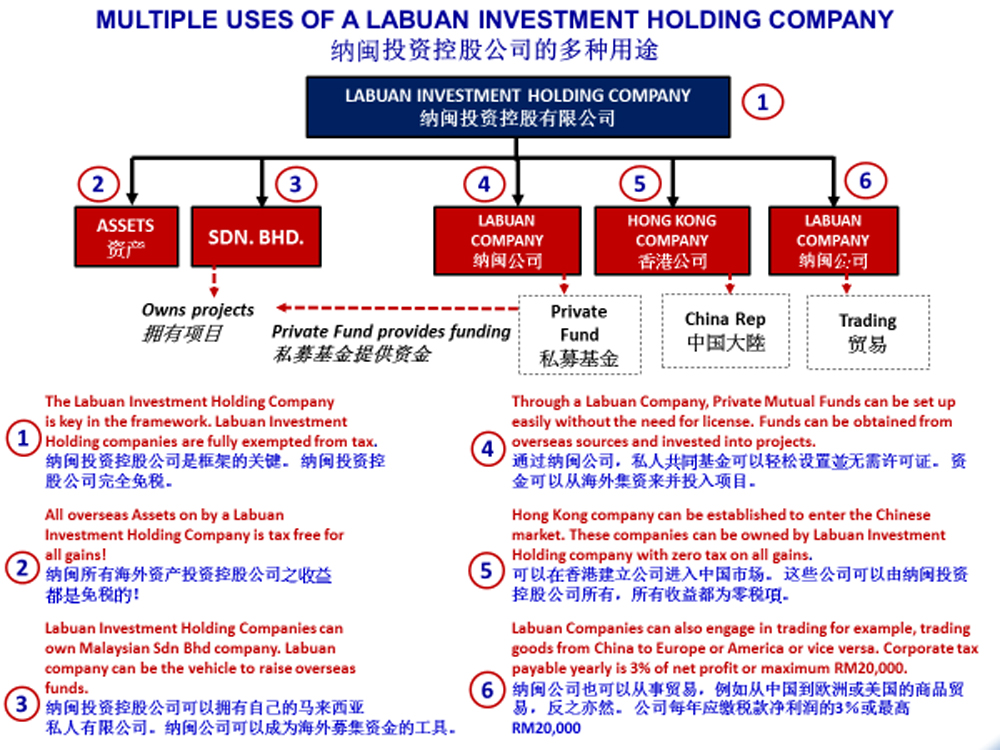

Labuan business activity means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan in a currency other than Malaysian currency by a Labuan entity with non-resident or with another Labuan entity. Labuan underwriting manager or Labuan underwriting takaful manager. Labuan entities carrying on a Labuan business activity that is a Labuan trading activity generally are taxed at 3 of their net audited accounting profits chargeable profits under the Labuan Business Activity Tax Act 1990 LBATA.

Under the revised Section 2B 1 b of the Labuan Business Activity Tax Act 1990 LBATA a Labuan entity must for the purpose of the Labuan business activity have an adequate number of full time employees and an adequate amount of annual operating expenditure in Labuan as specified under the Labuan Business Activity Tax Requirements For Labuan Business. 5 Derivation of Business Income Business income is subject to tax in Malaysia if it is derived or deemed to be derived from Malaysia. Labuans capital is Victoria and is best known as an offshore financial centre offering international financial and business services via Labuan IBFC since 1990 as well as being an offshore support hub for deepwater oil and gas activities in the region.

Define Labuan business activity. Means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law. Labuan insurer Labuan reinsurer Labuan takaful operator or Labuan retakaful operator.

Labuan business activity means. All the business activities depend on each other to ensure constant process and cannot serve the purpose of customer satisfaction solely. Minimum number of full time employees in Labuan.

Type of trading company including the c. What is the definition of Labuan business activities. Labuan Business Activity Tax Amendment Bill 2018 Highlights.

Any income which is not attributable to operations of any business carried on outside Malaysia shall be deemed to be derived from Malaysia. Labuan trading activities include banking insurance trading management licensing and shipping operations. An Act to provide for the imposition assessment and collection of tax on offshore business activity carried on by an offshore company in or from Labuan and for matters connected therewith.

However the Labuan tax regime has been revised the trading companies can no longer enjoy 3 of low corporate income tax since the implementation of Labuan Business Activity Tax Regulation 2018 instead the tax rate will be on par with normal Malaysia domestic company which is 24. Labuan business activities is defined as a Labuan trading or non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law. 1 October 1990 PU.

LABUAN IBFC Concepts and definition of major terms. Labuan entity carrying on a Labuan business activity. Means an activity relating to the holding of investments in securities stock shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

B 5891990 BE IT ENACTED. A Labuan trading or a Labuan non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law. Minimum amount of annual operating expenditure in Labuan RM 1.

04 What is the rate of tax imposed on Labuan business activities.