How To Setup Company In Labuan

Voluntary Winding Up Under Section 131A of the Labuan Companies Act 1990 or more frequently known as Liquidation This is the best and preferred method to dissolve a Labuan Company. Imagine the money you could save in a year or in about 10 years.

Pin By Kobitar Kabbo On Photos Diy Kids Games Diy For Kids Games For Kids

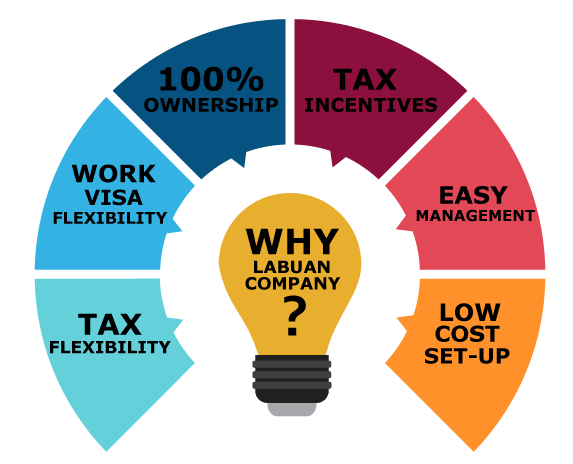

Obviously relocating your business to Labuan could be a strategic business decision that could save your company significant money and unshackle your enterprise from the chains that are holding it back taxes.

How to setup company in labuan. Memorandum and Articles of Association a consent form from the company director a Statutory Declaration of Compliance and the required fee. Decide on Paid-Up. Business nature and Structure of the Company to align with tax and compliance 2.

3E Accounting Team is a professional team that provide a one-stop-solution which include accounting taxation secretarial and marketing for you to setup your company in Labuan. The company name must end with one of the following words or abbreviations. Send the company kit to your address Your companys original documents will be sent to your provided address via mail DHL TNT FedEx.

Low Tax The corporate income tax for a company in this special region is only 3 on your profit and in some cases companies are completely exempt from the profits tax. The company is required to have a registered office in Labuan which may be a virtual office as described below. A name once reserved is valid for three months.

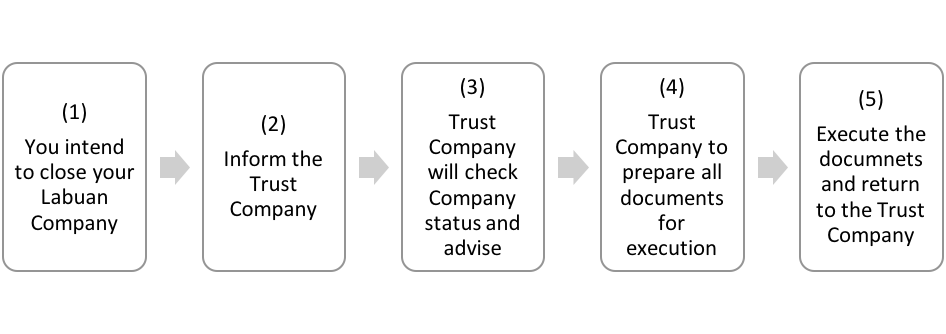

To set up a Labuan Company you should reserve your company name by applying for approval with the Registrar with an application fee of RM 50. Guide to Setting Up Business in Labuan - Familiarise and Understand the Jurisdiction Setup Requirements for Labuan Company Incorporation Services. There are two ways on how to dissolve a Labuan company.

In most cases including reservation of name a Labuan Company can be incorporated within 1-2 days. Registration of Company Registration of this offshore company involves submitting to the Registry the following documents. Approval will be granted within 24 hours and the name can be reserved for up to 3 months.

Bank account opening Serviced office license or Trademark application can be subsequently fulfilled at this time. Decide your Company identity- please propose 3 names to check for availability and decide on suffix to be used. Incorporation of a Labuan company in Labuan IBFC must be done through a Labuan trust company.

Please allow 1-2 weeks for corporate kits to be sent. However it is the most expensive amongst the two methods. The best news is that you are not required to deposit any share capital when registering a Labuan international company.

Business nature and structure of the Company to align with tax and compliance. Currently the new set up for pure equity holding company dont require any staff in Labuan but require a minimum annual spending of RM 20000. Called Labuan Company which in most cases must be companies limited by shares.

However for non pure equity holding company require an operational office in Labuan with a minimum of 2 staff with minimum annual spending of RM 20000. The Labuan Financial Services Authority can reject the name if it is undesirable. With respect to the shareholding and management structures the Labuan international company must have at least one shareholder and one director.

You dont have to jump-start a business but engage with us we will help you to setup Company for you. The application should be submitted together with the Memorandum and Articles of Association consent letter to act as director statutory declaration of compliance as well as payment of registration fees based on paid-up capital. In Labuan its tax-free if starting a non-trading company and only a 3 tax rate if opening a trading company.

The taxes and costs associated with setting up a company in Labuan and a residential address are lowthe minimum paid-up capital for the company needs to be only 1 USD. The process of incorporating a Labuan company is simple and foreign investors can have full foreign ownership over the legal entity they register here. It may take 2 to 5 working days to deliver the company kit after your company is incorporated.

The most commonly used business form is the Labuan international company the legal entity that allows for 100 foreign ownership and benefits from all of the tax advantages practiced in Labuan. Labuan Limited CoLtd Inc Ltd or LLC. Another requirement is for the company name to bear the suffix Labuan.

Lets register labuan company now. The company must have at least one company director and a resident secretary. Once your personal profile and your objective for setting up the Labuan Company have passed the required due diligence we will recommend you the right entity and guide you each step to set up Labuan Company in Malaysia successfully as follows.

Here are the 5 simple steps how to set up Malaysia Labuan Offshore Company. Below we summarize once again the main characteristics and requirements for a Labuan company.